Simplified Method Worksheet Schedule C Example

For example a sporadic activity not-for-profit activity or a hobby does not. Simplified method worksheet schedule c.

Form 8829 Instructions Your Complete Guide To Expense Your Home Office Zipbooks

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor.

Simplified method worksheet schedule c example. Schedule C line 30. Add all these expenses up and subtract them from your. Alabama Schedule AAC Adoption Credit.

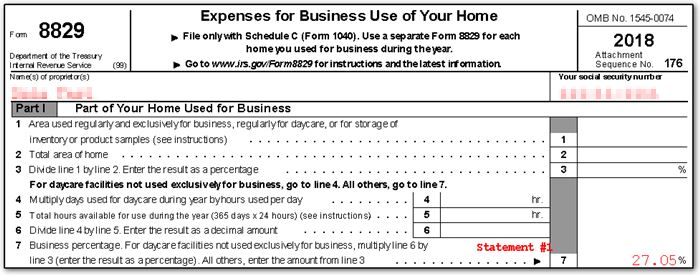

If it is attached to any other entity Schedule A Schedule F or Form 2106 the Business Use of Home worksheet will be produced. And you are filing Schedule C Form 1040 you will use either Form 8829 or the Simplified Method Worksheet in your Instructions for Schedule C. Simplified method worksheet schedule c.

Posted June 12th 2021. Subtract line 30 from line 29. Click the checkboxes to the left of what you wish to print the top section contains.

If not electing to use the simplified method use form expenses for business use of your home. If you are filing Schedule C Form 1040 to report a business use of your home in your trade or business and you are using the. Simplified method worksheet schedule c.

Ad the most comprehensive library of free printable worksheets digital games for kids. Home Uncategorized simplified method worksheet schedule c. If not electing to use the simplified method use form expenses for business use of your home.

Luckily for many who cant afford to foot the bill that may encounter thousands there are alternatives if you want to get your own website up and running. Make no mistake about it developing a great website costs money. If a profit enter on both.

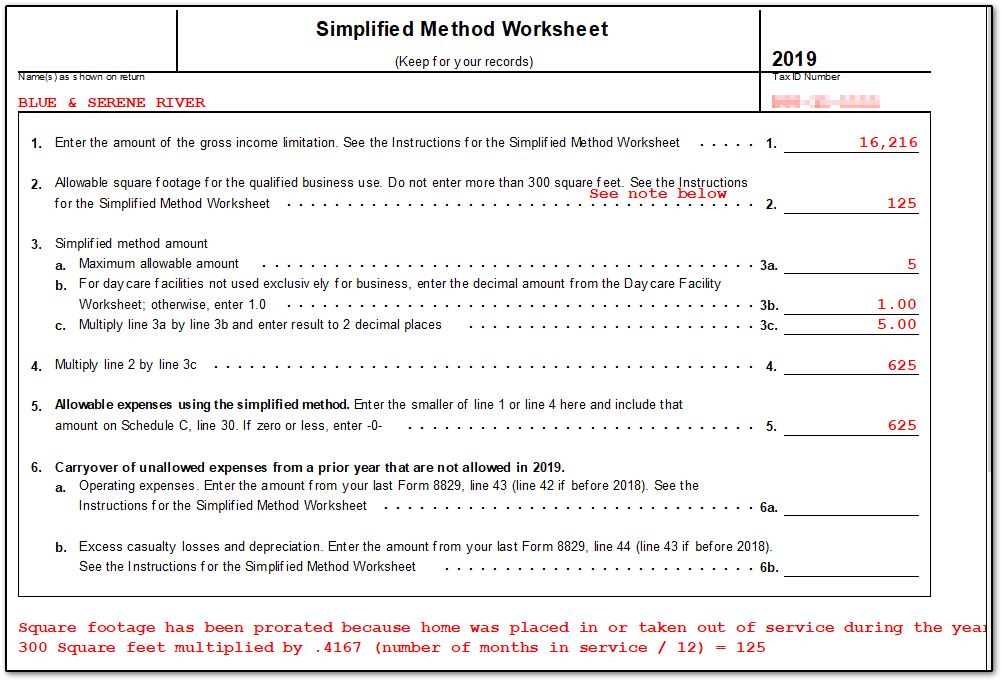

Posted on June 12 2021 by. The 1040-SR is available for seniors over 65 with large print and a standard deduction chart. Instructions for the simplified method worksheet use this worksheet to compute the amount of expenses the taxpayer may deduct for a qualified business use of a home if electing to use the simplified method for that home.

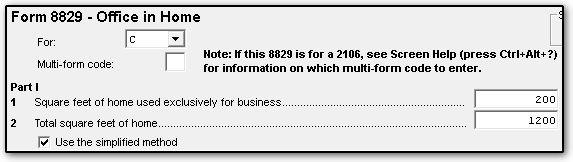

The calculation is shown on the Simplified Method Worksheet Form 8829 - Simplified in view mode. Enhancements to the 8829 screen starting in Drake19 allow for a part-year Office. We welcome your com-ments about this publication and.

Form 1040-EZ and Form 1040-A are no longer available. Form 8829 will be produced only if Interview Form M-15 is attach to a Schedule C. No home depreciation deduction or later recapture of depreciation for the years the simplified option is used.

For 2019 and beyond you may file your income taxes on Form 1040. On average this form takes 5 minutes to complete. Worksheet Pics Worksheets Grade 3 Free Printable Percentage Math Work Genius.

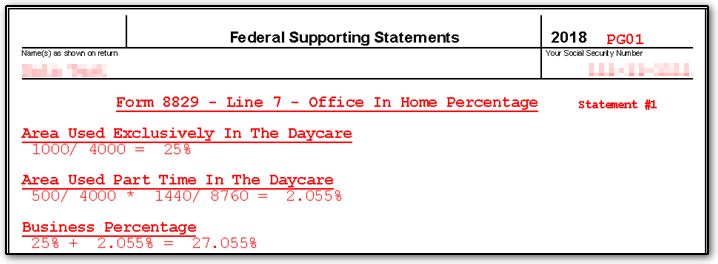

Ad the most comprehensive library of free printable worksheets digital games for kids. Then on Line 30 youll dig into expenses from business use of your home using either the Simplified Method Worksheet on page 11 of the Schedule C instructions or Form 8829 to calculate that number. In the example above Schedule C displays the calculations on line 30.

31 Net profit or loss. The form is used as part of your personal tax return. Because of the Daycare Facility Worksheet on page C-11 of the instructions it is.

An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. Simplified method worksheet before you begin if you are the beneficiary of a deceased employee or former employee who died before august include any death benefit exclusion that you are entitled to up to in the amount entered on line below. Form 2106 line 4.

If you need information on deductions for renting out your property see Pub. Epg2 as UPE Unreimbursed Partnership Expenses line 28. Scientific Method Worksheet Scientific Method Worksheet.

Simplified method filers only. Back to 11 Simplified Method Worksheet Schedule C. Deduction for home office use of a portion of a residence allowed only if that portion is exclusively.

Posted on 12th June 2021 by. 527 Residential Rental Property. The rules in this publication apply to individuals.

The Simplified Method Worksheet and the Daycare Facility Worksheet in this section are to be used by taxpayers filing Schedule F Form 1040 or by partners with certain unreimbursed ordinary and necessary expenses if using the simplified method to figure the deduction. Enter the total square footage of a your home. If you want to use the simplified method your deduction is 5 x 150 sq.

Also enter this amount on form 1040 line 16a. Jun under the simplified method you figure the taxable and parts of your annuity payments. Allowable home-related itemized deductions claimed in full on Schedule A.

Use the SimplifiedMethod Worksheet in the instructions to figure the amount to enter on line 30. Simplified Option Regular Method. Schedule F line 32.

And b the part of your home used for business. The IRS Schedule C form is the most common business income tax form for small business owners. The glamorous digital imagery below is section of Simplified Method Worksheet report which is categorised within Budget Spreadsheet simplified method worksheet example simplified method worksheet calculator simplified method worksheet schedule c and published at July 27th 2021 172651 PM by Azeem Morris.

Instructions for the simplified method worksheet use this worksheet to compute the amount of expenses the taxpayer may deduct for a qualified business use of a home if electing to use the simplified method for that home. For example if you have an office space of 150 square feet and your home is 1200 square feet you are under the maximum of 300 square feet for the simplified deduction so you have the option of taking either the simplified or the regular deduction. When You Realize Youre The Problem Stages Of Pregnancy Worksheet Pdf Incendiary Fuel Crossword Clue Google Sheets Sumif Not Blank Memo To Employees Regarding Time Off Best Vacation Investment Property Locations 2021 No.

Mortgage interest real estate taxes. Simplified Method Worksheet Example. If you should be good with words and you have recommended of what you would like.

Free Printable Scientific Method Graphic Organizer Interactive Notebook.

Pub 17 Chapter 10 11 Pub 4012 Tab D 1040 Line 16 Ppt Download

Https Www Irs Gov Pub Irs Prior I1040sc 2018 Pdf

11781 Form 8829 Office In Home

Simplified Home Office Deduction When Does It Benefit Taxpayers

8829 Simplified Method Schedulec Schedulef

Schedule C Pdf Schedule C Form 1040 Profit Or Loss From Business Omb No 1545 0074 2017 Sole Proprietorship To Www Irs Gov Schedulec For Instructions Course Hero

Schedule C Self Employment Covered Ca Subsidies Home Office Hobby

Schedule C Self Employment Covered Ca Subsidies Home Office Hobby

Https Www Irs Gov Pub Irs Utl 2015 Ntf Employee Business Expense Eng Pdf

Https Apps Irs Gov App Vita Content Globalmedia 1099r Pension And Annuity Income 4012 Pdf

Simplified Home Office Deduction When Does It Benefit Taxpayers

Https Www Efile Com Tax Service Pdf 0015 Pdf

Irs Offers An Easier Way To Deduct Your Home Office Don T Mess With Taxes

8829 Simplified Method Schedulec Schedulef

Http Www Lendersonlinetraining Com Wp Content Uploads 2016 12 Smith Eric Greenstone 1040 Case Study 2016 Dec Lgk Review Pdf

8829 Simplified Method Schedulec Schedulef

Home Daycare Tax Worksheet Worksheet List

Post a Comment for "Simplified Method Worksheet Schedule C Example"