Ppp Schedule A Worksheet Example

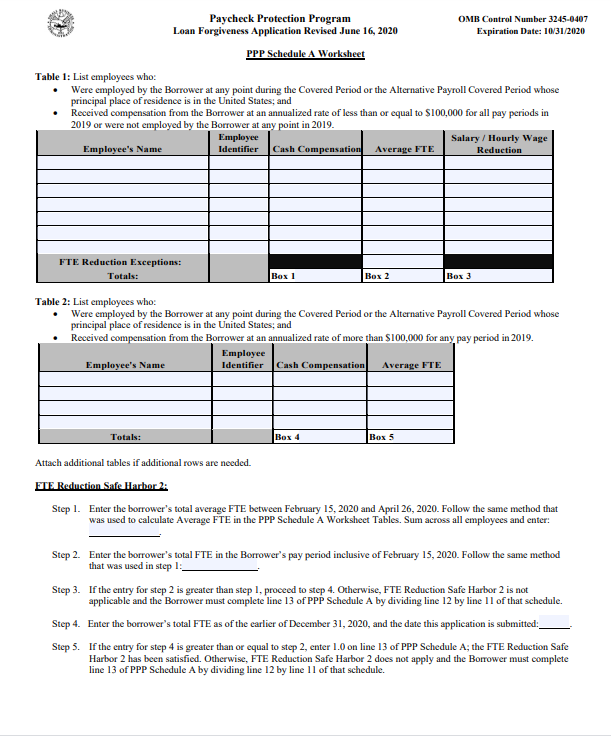

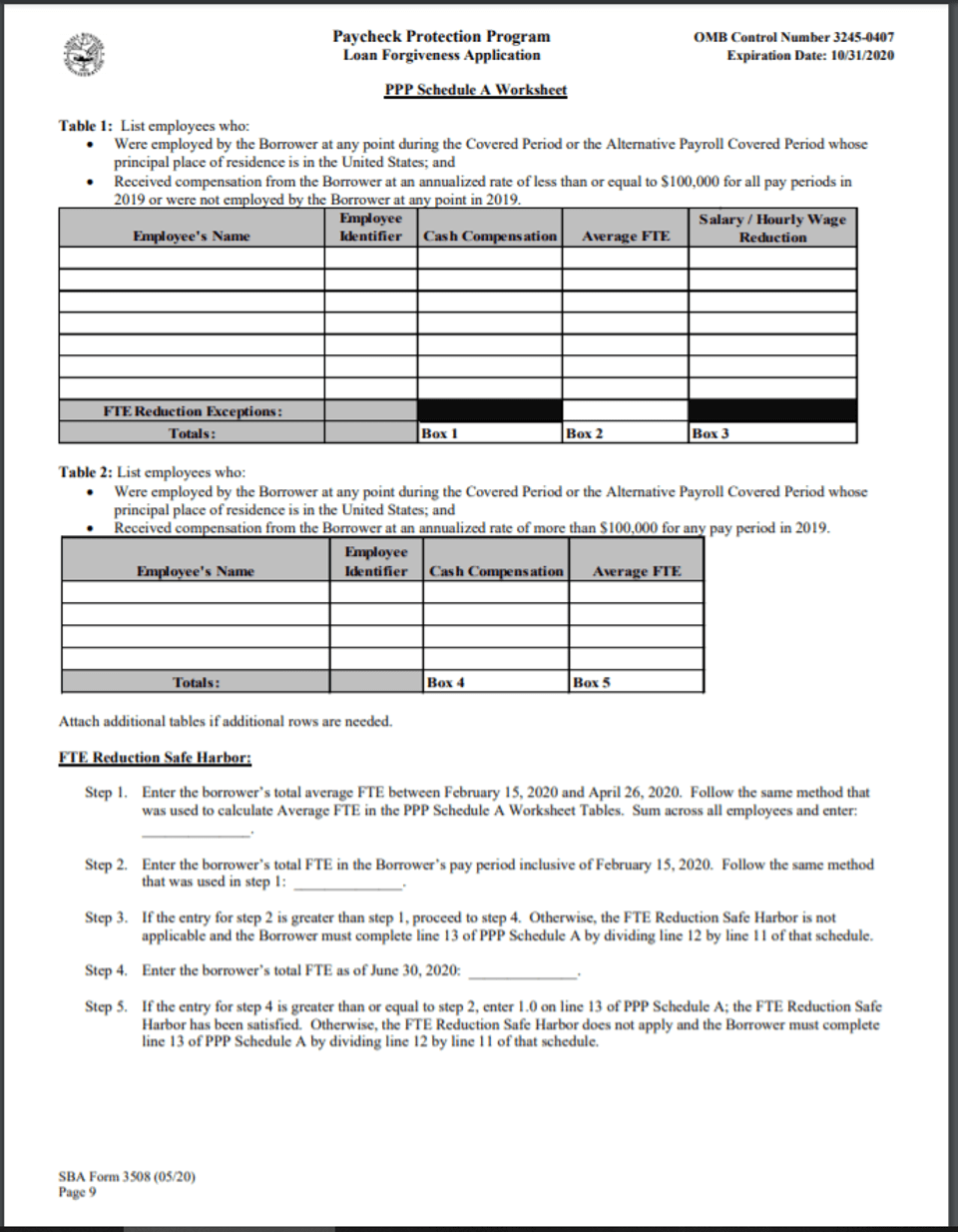

To first complete your 100000 validation click 1. Use the information from your worksheet to complete the PPP Schedule A.

Ppp Loan Forgiveness Process Part 3 How To Complete The Sba 3508 Loan Forgiveness Application The Final Piece Anchor Business Brokers

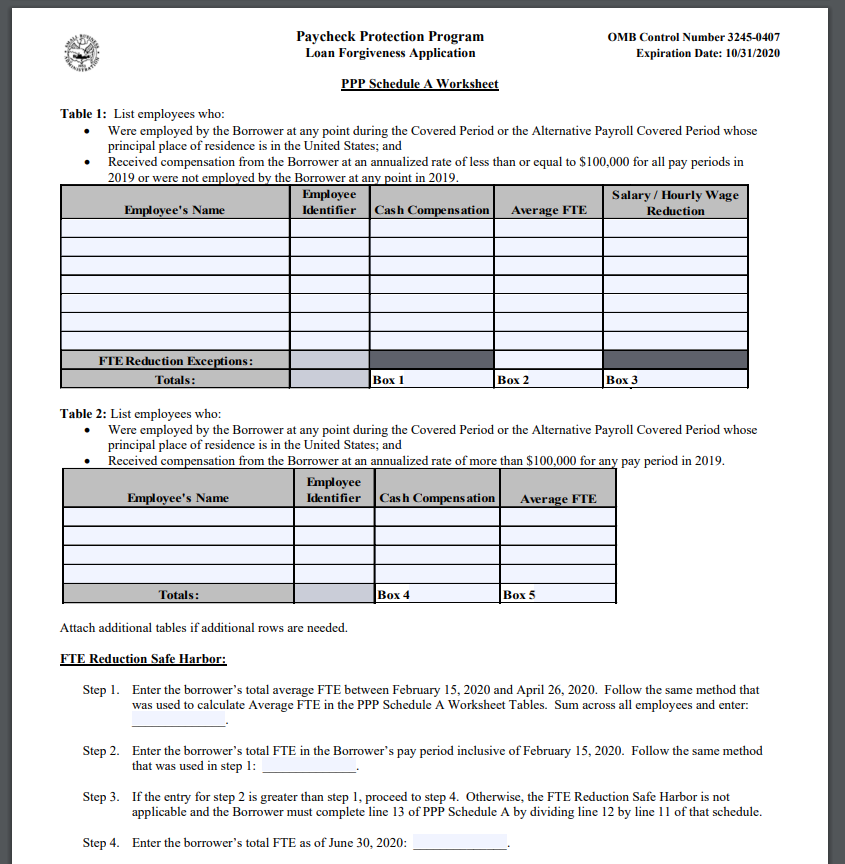

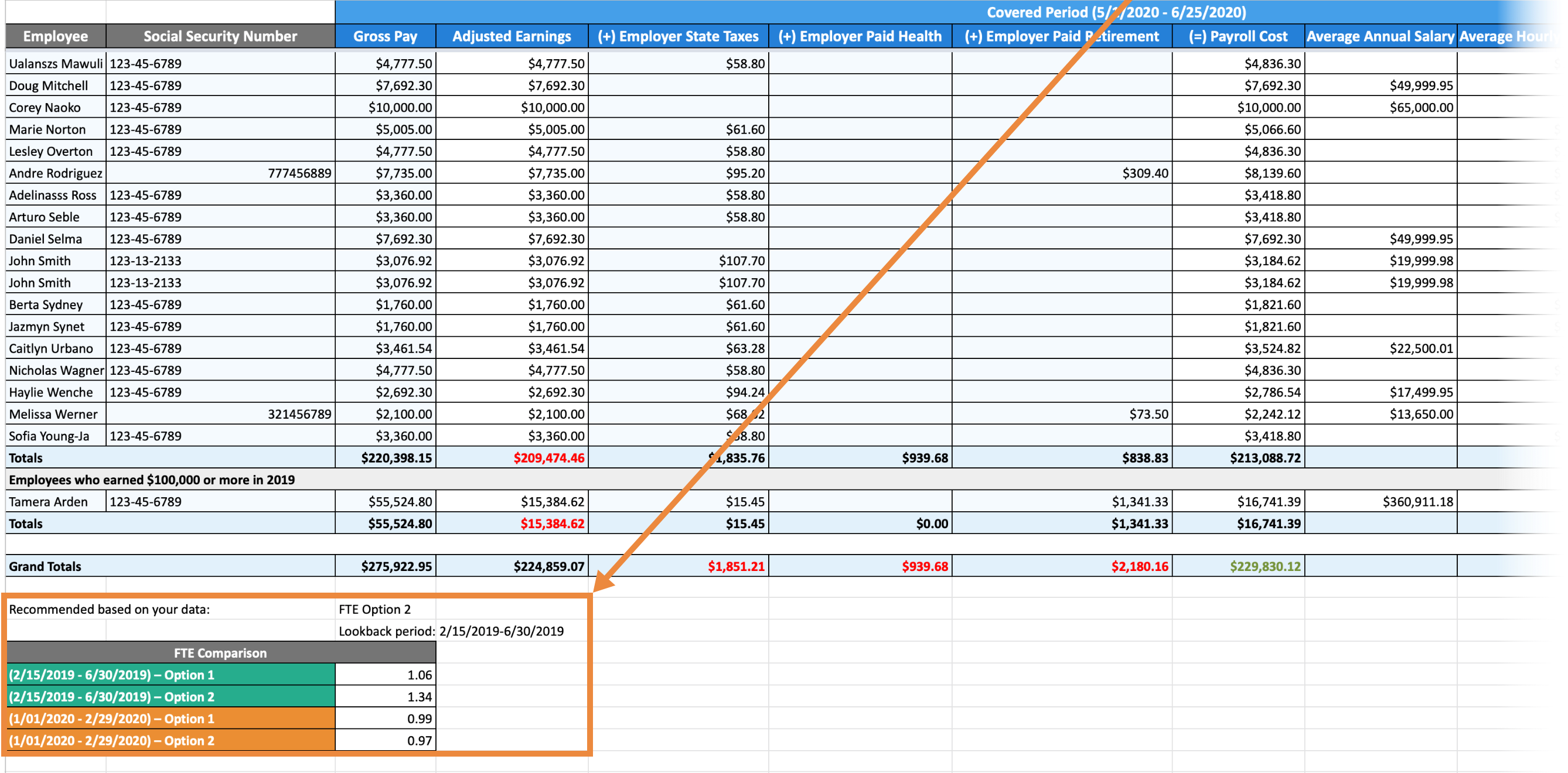

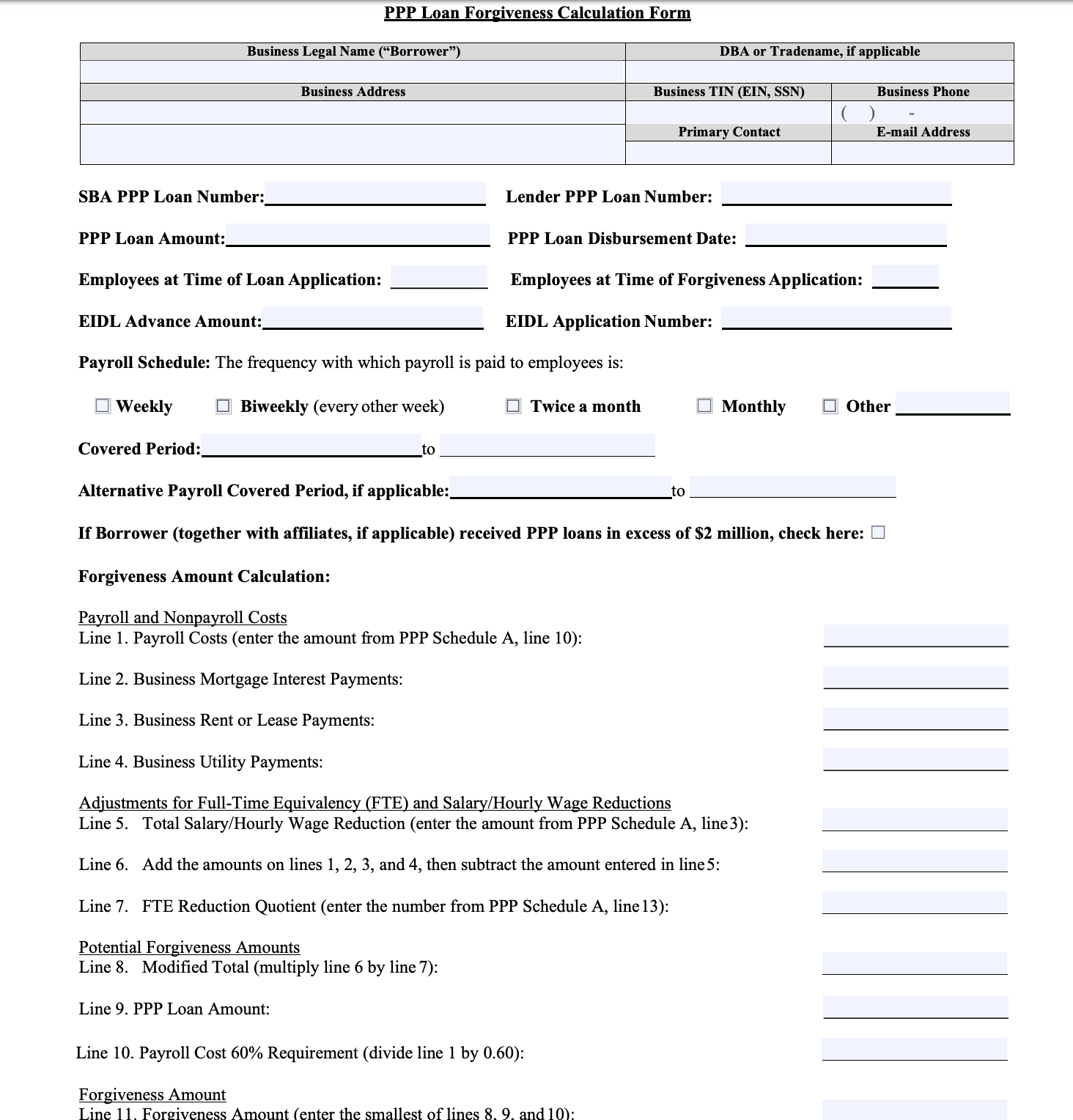

Enter the amount in Box 1 Cash Compensation Table 1 from the PPP Schedule A Worksheet.

Ppp schedule a worksheet example. Alternative Payroll Covered Period. Launch the PPP Forgiveness module. For example if the Borrower received their PPP loan proceeds on Monday April 20 2020 the first day of the Covered Period is Monday April 20 2020 and the final day of the Covered Period is any date selected by the Borrower between Sunday June 14.

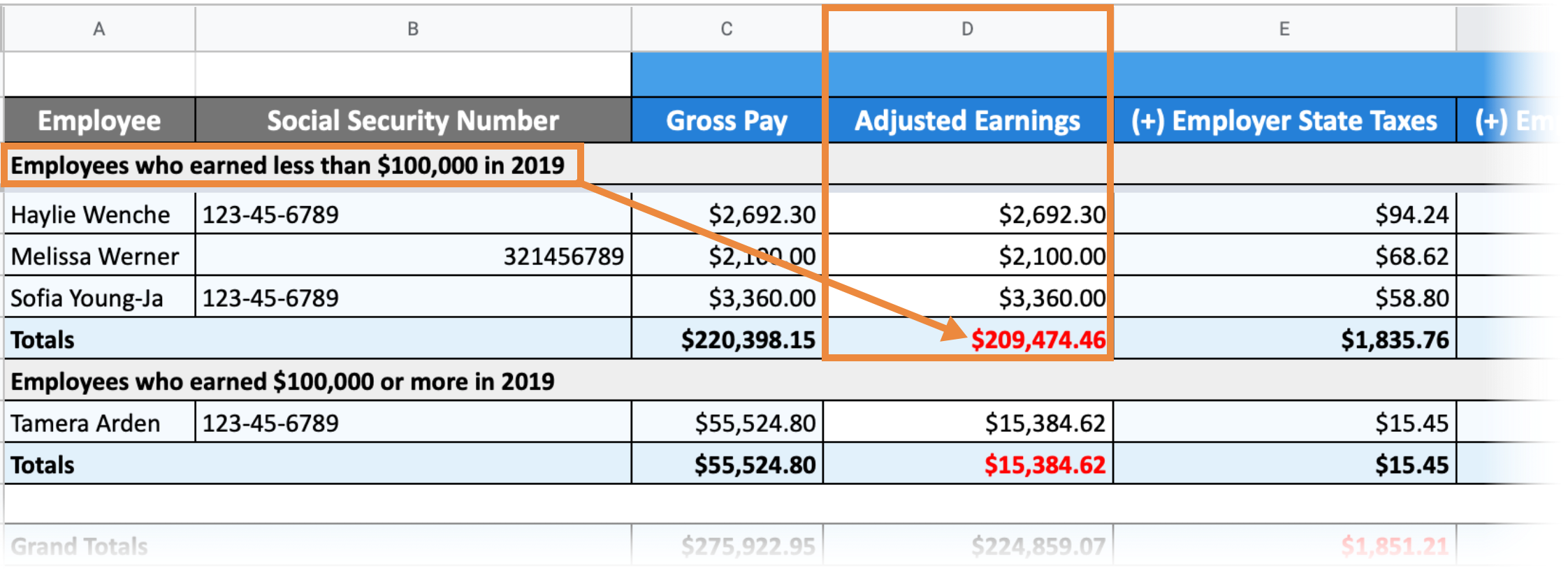

Claim a deduction for these expenses on your 2019 Form 1040 Schedule C in order to claim them as expenses eligible for PPP loan forgiveness in 2020. The borrower would enter on the PPP Schedule A Worksheet Table 1 400 as the salaryhourly wage reduction in the column above box 3 for that employee. Here you will identify any employees that received compensation at an annualized rate of more than 100000 for any pay period in 2019.

Download your free PPP Loan Forgiveness Spreadsheet for forgiveness amount calculation PPP schedule and worksheet and more to help you apply. For administrative convenience Borrowers with a biweekly or more frequent payroll. Identifying Your 24-Week Period.

Now you will use the information you just filled out to fill out the PPP Schedule A. - Eight-week 56-day period begins on the PPP Loan Disbursement Date. Enter the total from Box 3 SalaryHourly Wage Reduction from the PPP Schedule A Worksheet.

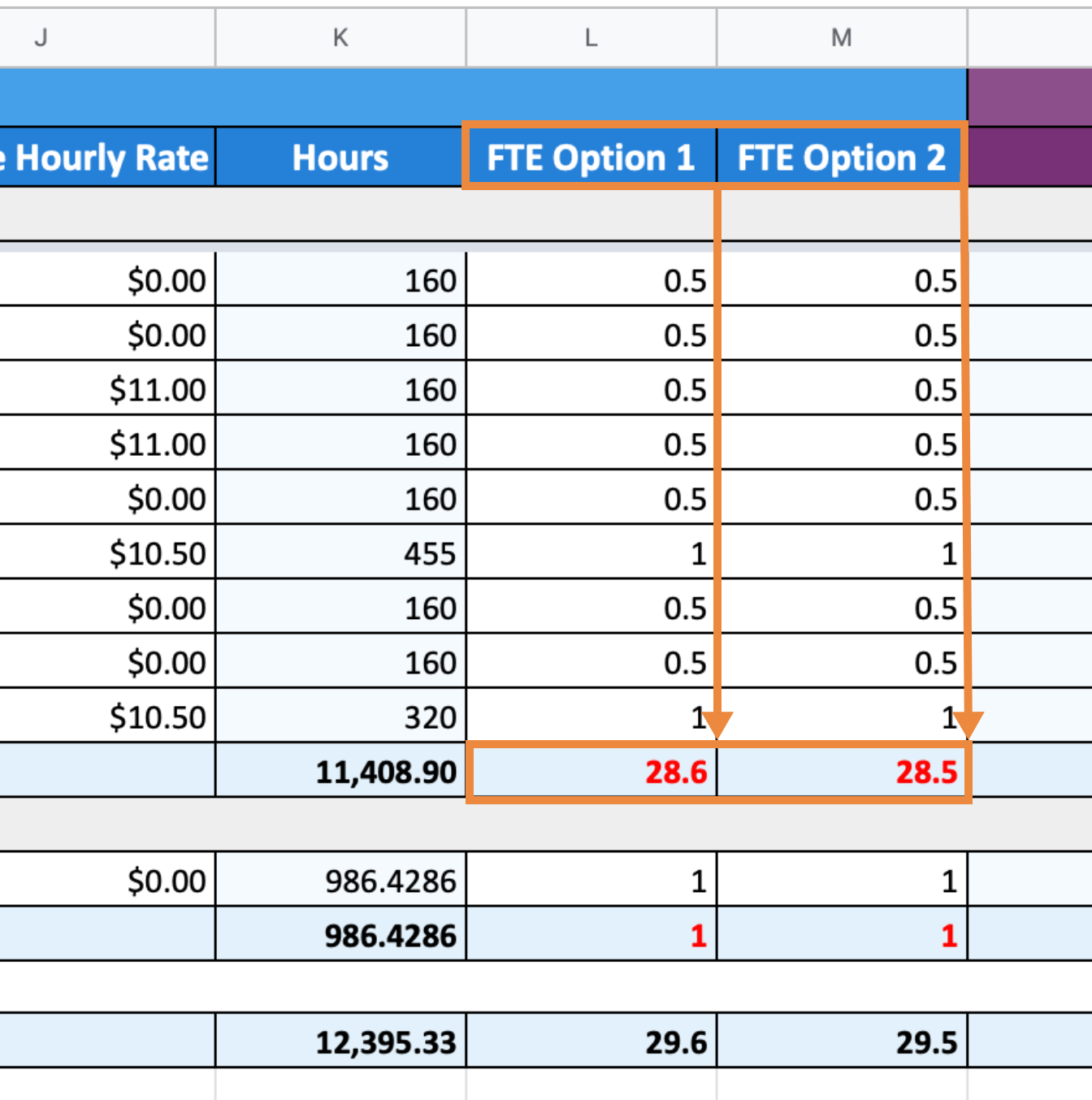

When it comes to PPP forgiveness calculation you need the PPP Schedule A Worksheet PPP Schedule A and PPP Loan Forgiveness Calculation Form in that order. The churchs standard Covered Period begins on June 1 2020 the date its PPP loan was disbursed. Of course you might want to.

PPP Schedule A Worksheet Table 1 Totals. For example if the Borrower received its PPP loan proceeds on Monday April 20 the first day of the Covered Period is April 20 and the last day of the Covered Period is Sunday June 14. For example use the pay period of February 14 2020 to February 28 2020 if your employees get paid biweekly.

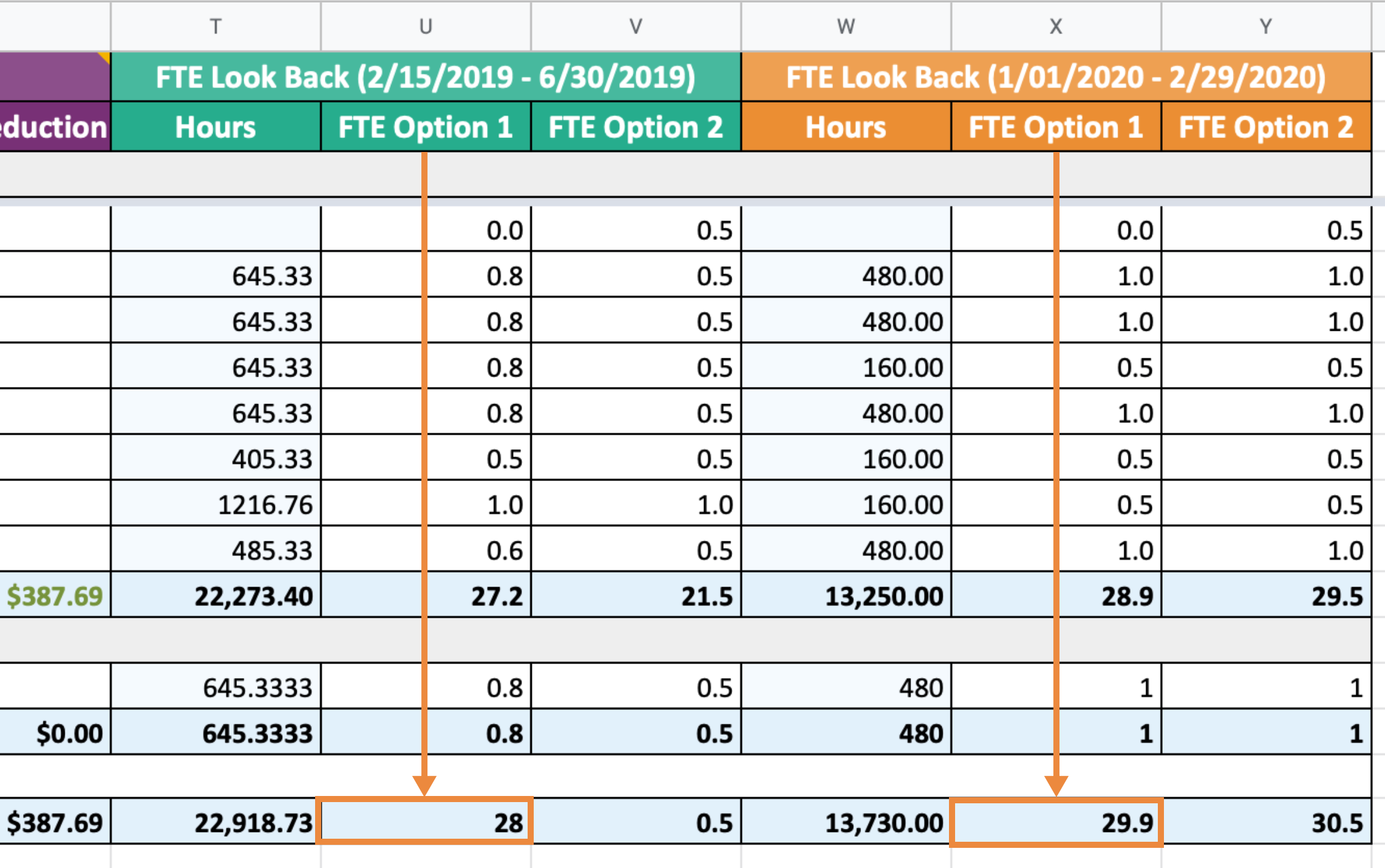

Youll need this information to calculate how much forgiveness your business can qualify for. For example under the FTE Reduction Safe Harbor. The PPP loan amount was used to cover approved expenses.

When calculating the FTE Reduction Exceptions in Table 1 of the PPP Schedule A Worksheet on the Loan Forgiveness Application do borrowers include employees who made more than 100000 in 2019 those listed in Table 2 of the PPP Schedule A Worksheet. PPP Schedule A Worksheet FTE and WageSalary Reductions 4. For example if the Borrower received its PPP loan proceeds on Monday April 20 the first day of the Covered Period is.

Filling Out PPP Schedule A. Or is it based soley on business revenue. The 24 weeks 168 days beginning on the day the PPP loan was disbursed or.

If you paid all of your employees at least 75 of. How to Complete Your Schedule A Worksheet. PPP Schedule A.

Schedule may elect to calculate eligible payroll costs using the eight-week 56-day period that begins on the first day of their first pay period following their PPP Loan Disbursement Date. The first day of the churchs first payroll cycle that begins after June 1 2020 is Sunday June 7 2020. Optional PPP Borrower Demographic Information Form.

PPP schedule and worksheet and more to help you apply. A borrower received its PPP loan before June 5 2020 and elected to use a 24-week Covered Period. Form 3508 is the most comprehensive of the three loan forgiveness applications and requires applicants to complete the Schedule A worksheet which outlines expenses and calculates reductions to FTEs and employee salarieswages.

For example if the Borrower received its PPP loan proceeds on Monday April 20 and the first day of its. PPP Schedule A Worksheet has Table 1 and Table 2 which asks for employee name employee identifier cash compensation average FTE and salary. Qtr 2 was down 41 but received 1st PPP loan that quarter which when added in only makes that quarter down 15.

For example spreadsheet mentioned in May 21 Facebook Live click here. If you received a primary PPP loan in the quarter you were down 25 does that PPP loan amount count as revenue. If youre applying for a loan through the same lender as your first PPP--and your loan is less than 150000--you do not need to submit 2019 payroll documentation.

Navigate to the Schedule A Worksheet at the top of the page. The file will appear in your downloads. Lines 1 5 should be pretty self-explanatory as they will be filled out using the information from the worksheet you just completed.

When calculating the FTE Reduction Exceptions in Table 1 of the PPP Schedule A Worksheet on the Loan Forgiveness Application SBA Form 3508 or lender equivalent do borrowers include employees who made more than 100000 in 2019 those listed in Table 2 of the PPP Schedule A Worksheet. Enter the total from Box 2 Average FTE Table 1 from the PPP Schedule A Worksheet. PPP Borrower Demographic Information Form Optional Instructions for Borrowers.

An hourly wage employee had been working 40 hours per week during the. However we think it is prudent to use this worksheet to work through both the FTE calculation and Wage Reduction calculation. Maple Grove Church uses a biweekly payroll schedule every-other-week.

PPP Schedule A Worksheet. Documentation supporting the listing of each individual employee in PPP Schedule A Worksheet Table 1 including the SalaryHourly Wage Reduction calculation if necessary. PPP Schedule A Worksheet is not required to be submitted to the lender.

PPP Schedule A Worksheet or its equivalent and the following. The 24-week period during which expenses must be incurred or paid. This is found on Page 3 of the application.

Towards the second PPP loan.

How To Fill Out The Schedule A Worksheet Using Onpay S Ppp Loan Forgiveness Report Help Center

Ppp Loan Forgiveness Application And Instructions Released By Sba Current Federal Tax Developments

Calculate Ppp Forgiveness With Fte 8 Week 24 Week And Flexibility Act Considerations Youtube

How To Fill Out The Schedule A Worksheet Using Onpay S Ppp Loan Forgiveness Report Help Center

Ppp Loan Forgiveness For Chiropractors Application Explained Here

Ppp Loan Forgiveness Application Guide Updated Gusto

Ppp Loan Forgiveness Application Guide Updated Gusto

How To Fill Out The Schedule A Worksheet Using Onpay S Ppp Loan Forgiveness Report Help Center

Ppp Loan Worksheet Tutorial Youtube

Ppp Loan Forgiveness Application How To Calculate Fte S Updated Template Youtube

Ppp Loan Forgiveness Application Guide Updated Gusto

A Simple Guide To Fill Out Your Ppp Forgiveness Application Form Hr Wise Llc Hr Payroll Services

Sba Releases Paycheck Protection Program Loan Forgiveness Application A Deep Dive Sc Small Business Chamber Of Commerce

How To Fill Out The Schedule A Worksheet Using Onpay S Ppp Loan Forgiveness Report Help Center

The Not Quite Definitive Guide To Paycheck Protection Program Loan Forgiveness

Https Www Postschell Com Uploads Post Schell Ppp Tool How To June 2020 Pdf

How To Fill Out Your Ppp Forgiveness Application Form Simplifi Payroll And Hr

Https F Hubspotusercontent20 Net Hubfs 5288175 6 29 2020 20ppp 20full 20forgiveness 20app 20update 2 20 1 Pdf

Post a Comment for "Ppp Schedule A Worksheet Example"